Optimists may be a happy lot, but optometrists cannot afford to view the world through rose-tinted glasses; reality has to prevail, sooner or later.

Markets are currently in the optimists’ embrace, with Indian stocks have shrugged off tariff tantrums (aided by the 90 days pause on them), and looked forward to assessing the contours of trade deals that the US administration has been engaged in making.

At the time of this writing, a cessation of hostilities have been announced with Pakistan, after some escalations in strikes and counter-strikes over the last week, and talks are currently underway.

The US administration has also announced a trade deal with its nemesis, China, though no details have been shared yet.

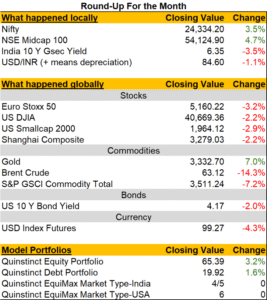

The Nifty built on the 6.3% return in March with a 3.5% gain in April, putting it at just a 7% decline from its peak of 26,215 in Sep 2024. It also recovered by 10% from its Apr 7, 2025, level of 22,162.

The mid and small cap indices also recovered sharply and ended down 11% and 16% respectively from their all-time highs.

Good news on the currency front also, as the INR gained another 1.1% in April, on the back of a 2.2% gain in March.

With a second rate cut of 0.25% by the RBI in early April, domestic interest rates are also softening. Witness the fact that the Quinstinct Debt Model Portfolio, a mix of AAA-oriented medium-term funds (67%) and Dynamic Bond Funds (33%) has moved up by 1.6% over the month!

What comes next? Are equities over-valued again, especially after a 2%+ run-up in the Nifty this week? Is the debt bull market done? Are the war and tariff related concerns behind us?

While the results season is underway, and we will have an analysis of the March 2025 results for you in our next report, the Market Type has moved close to a 5, currently.

While the mood has moved to “risk-on”, based on tariff fears easing, and a potential deal with China, as we predicted in our last report, high valuations can mean considerably sharp corrections if the mood reverts to “risk-off”.

While the ‘India story’ (we are better positioned than most major economies to offer relatively better growth) still holds, higher valuations and progression to a higher market type does mean there is risk of euphoria building up. Value may indeed be in the eye of the beholder, but such eyes cannot afford a rose-tinted view of markets forever, and significant downsides result when reality returns.

With the repo at 6% currently, and April inflation coming in well below the RBI’s 4% benchmark, the stage is set for a further easing of interest rates.

A currency that has reversed some of the depreciation of the risk-off phase also allows the central bank some headroom in this respect.

Given that longer maturity bonds appreciate more in price for a given reduction in interest rates, the rewards of declining rates can be captured optimally by some allocations to the Dynamic Bond category, with the balance being in safer AAA oriented medium term bond portfolios.

For Equity we continue to hold on to existing positions, any lump sum additions should only be done if one is severely under-exposed to equities at this point in time.

In Debt we continue to recommend a majority of fresh allocations to both AAA-oriented medium-term debt funds as well as Dynamic Bond Funds. Arbitrage funds (given their current good yields and tax benefits), could also serve as a temporary holding space for asset allocation rejigs.

If you have not taken our risk profile questionnaire, or have taken it more than a year back, please do so immediately at https://report.quinstinct.com/riskprofiler. We depend heavily on this input to decide on changes to your asset allocation, and this would guide our recommendations to you, especially if markets move to a Market Type 6.

Did you find this useful?