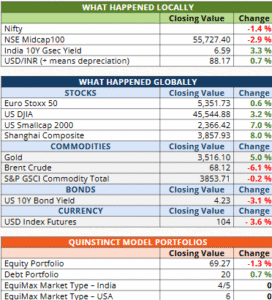

Many client conversations over the last month have been centred on stock market volatility, and what to expect on the tariff front, going forward. And when we talk of the Market Type currently being on the 4/5 border, and that a MType 6 could be obtained closer to 28,000-30,000 on the Nifty, there is incredulity on whether we are going to get there, even by end-2026.

This, therefore, is a good time to step back, and remind ourselves that stock markets in the long-term are not driven by Mr Trump’s whims, but by underlying earnings growth. We would be better served by focusing on this, rather than the slings and arrows of tariffs, definitely high impact events but shorter term in nature.

But will tariffs, if not resolved soon, not lead to job losses, especially in SME exporters to the USA? And how would that affect demand, and therefore earnings growth?

While this cannot be answered with certainty, some preliminary calculations we did to estimate demand impact, with certain assumptions, indicate to us that given GST reforms, less-vulnerable higher income households could step in with higher consumption and make up the deficit created by job losses in lower income households exposed to these industries, leaving overall demand levels healthy. However, the rise of economic inequality would be camouflaged by the aggregate numbers, and these could lead to long-term structural problems, if not tackled soon.

The market reaction also, indicates a wait-and-watch mode: since the eruption of this tariff action early in August, the Nifty has slipped 3% from its June close. Mid and small cap indices have been a bit more volatile, losing 4.5% and 7.4% respectively from the June 2025 close.

What can we expect on earnings growth, given the muted numbers from the June 2025 earnings season?

We have already highlighted in our webinars (https://www.youtube.com/watch?v=7tsGrigICh0 on 01-03-2025 and https://www.youtube.com/watch?v=hQu7HJ0RROw on 11-07-2025) that (1) muted earnings growth from Sep 2024 was due to a cyclical downturn in sales and (2) the cycle would probably start turning in 2025, maybe from the Sep quarter earnings.

The surplus income that will accrue to households from the 2025 Union Budget, where incomes up to ₹12 lacs for any tax period were exempted, plus the rationalization of GST slabs from 5%,12%,18% and 28% to 5% and 18% with a 40% special category for ‘sin’ goods should also have a disinflationary impact, and provide a boost to consumption.

If these measures, along with the lower base effect, restore sales (demand) growth of the 235 odd BSE 500 companies we track quarterly back to the 10% p.a. average, the disinflationary environment may provide a further gift of margin expansion, which could result in earnings growth above this average.

If this improvement coincides with a resumption of India-US trade talks a somewhat more favourable situation is negotiated by the end of this year, we may well still see a continuation to the smart recovery in markets that started in March 2025.

However, given the smart gains in equity from 2021 onwards, and further given that we are in a MType 4/5 border, we continue to recommend that fresh investments which may alter your allocation towards more risk than recommended by your risk profile, be avoided at this point in time. Existing SIPs and STPs, coming at lower and more volatile levels of the index, should continue.

At Quinstinct, we have always emphasized the asset allocation approach based on your risk profile and tools like our Market Type model (please go through the webinar recordings to refresh your memory if needed).

While interest rates continue to be soft, along with inflation, we believe we are at the fag end of the rate reduction cycle, and fresh exposures to longer maturity debt is not likely to out-perform going forward.

However, the 10-year GOI Bond whose yield had jumped beyond 6.6% (on fears that measures to combat tariff pressures by stimulating domestic demand would lead to more borrowing, and higher deficits), has, over the last few days in Sep 2025, seen a retreat to 6.45%. While we may see a 6.2% level on the 10-year bond with further rate cuts, this is quite near to the bottom of the cycle.

Rates are more likely to stagnate, or harden in 2026, and we must prepare accordingly.

We therefore would continue to recommend a majority of fresh allocations to both AAA-oriented medium-term debt funds. Any redeployments Dynamic Bond Funds, should also be deployed here, or into Arbitrage funds, which, given their current good yields and tax benefits, could also serve as a temporary holding space for asset allocation rejigs.

With equities poised between a Market Type 4 and 5, and debt yields moderating, your asset allocation would be a crucial input in deciding portfolio moves in the coming months.

If you have not taken our risk profile questionnaire, or have taken it more than a year back, please do so immediately at https://report.quinstinct.com/riskprofiler. We depend heavily on this input to decide on changes to your asset allocation, and this would guide our recommendations to you, especially if markets move to a Market Type 6.

Did you find this useful?