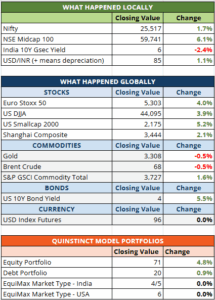

How high must markets go before ‘all-time highs’ become dangerous, and we must shift from a return-seeking to a wealth-preserving mode? This is especially relevant, given indices have moved another 6-8% over the last month, even as major global equity markets stagnate. Our market type model was developed with the sole idea of estimating an answer to this question, and the answer to the question as to whether markets are in a dangerous zone, seems to be ‘not yet’, but we’re getting there. More on this later in this note.

The India story has seen renewed emphasis and conviction among investors, and indeed, many parts of this story or hypothesis are true.

However, what is also true is that valuations (P/E multiples) are stretched, and this makes markets vulnerable to external shocks.

Also true is the assertion that consumption in the economy continues to lag; we only need to see the sales growth of the sample of BSE 500 companies we track on a quarterly basis to understand this. Sales growth for the 12 months ended Mar 2024 was at 6.4% YoY, compared to 20.3% and 24.1% for Mar 2023 and Mar 2022. Clearly the pent-up demand after the COVID lockdowns has played out, and we need to look for policy interventions to drive demand. This is what investors would look for in Union Budget 2024. Disappointments on this front may lead to some corrections in markets.

While sales growth has slowed, profit growth has remained strong; for Mar 2024, despite sales slowing to 6.4%, profits grew 15% YoY. This was mainly due to input costs dropping. However, with volatile oil and commodity prices, we cannot take further input cost drops for granted. Profit growth may moderate unless sales growth picks up.

This does not mean all parts of the market will fall; Government spending and investment has been strong, which is why we see new investing themes like infrastructure, energy and defence, which have outperformed.

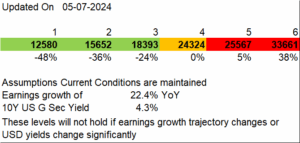

.Our Market Type still hovers on the 4/5 border (even though we continue to show a 5 on the main table). Based on some assumptions and extrapolations, the chart below shows the possible index (Nifty) levels at which market types would change

We are clearly starting to step into dangerous territory. However, given that prices today are largely being driven by domestic flows, and we have seen an average monthly flow of ₹ 18,000 Crore from domestic investors between Jan 2021 and Jun 2024, significant drops may not happen if, like in the past, investors keep pumping in money to ‘buy the dip’.

We are therefore inclined to hold our positions, while being extremely conservative on fresh allocations, at least till the Market Type firmly moves to a 6, at which point we would begin to bring equity allocations down in a staggered manner. How much down, would, of course depend on your risk profile.

Given this dependence on your risk profile for further action once we reach this point, may we request you to take the risk profile questionnaire (if you have not done so, or had done this more than a year back) at the earliest opportunity by going to https://report.quinstinct.com/riskprofiler.

On the fixed income/debt side, with international flows beginning thanks to the inclusion of Indian Government Bonds in the JP Morgan Emerging Markets Bond Index, the 10-year GSec yields are around the 7% mark. As the weight of Indian bonds moves up to 10% over the next few months, this should exert downward pressure on yields.

While the RBI has stayed put on keeping the repo at 6.5%, largely thanks to elevated food inflation, we do believe that there is scope for rates to ease as food inflation plays out and comes under control (provided we have a good monsoon).

We still believe that debt can provide good returns, maybe even better than equity at some point over the next two to three years.

Did you find this useful?